What Are The Biggest Ways Teams Underutilize Intent Data?

Intent Data | Demand Generation | April 7, 2021 | by Jaymi Onorato

Intent data is gaining more and more traction as we move further along into 2021—a soon-to-be-released survey from Ascend2 and Intentsify found that 82% of B2B marketers are already using intent data or rolling out a plan for its use (compared to 62% in 2020 and 48% in 2019, according to a TOPO survey).

Although more marketing and sales teams are rightly investing across various intent data sources, it’s easy to underutilize intent data if you don’t know how to effectively implement it, interpret the resulting insights, and put those insights into action. In fact, the same Ascend2 survey mentioned above found that 43% of B2B marketers agree that creating a strategy for the use of intent data is a top challenge.

Whether your team is already using intent data—or thinking about using it—it’s good to be aware of typical missteps to avoid. Here are some of the most common ways B2B teams are undermining the value of their intent data investments.

1. Limiting Intent Data to Top-of-Funnel Use Cases

Many B2B marketing teams see intent data as merely a tool for serving account-targeted display ads. In fact, the above-mentioned Ascend2 survey found that digital advertising was the most impactful use of intent data among respondents (64%).

While it’s incredibly valuable to generate awareness for your brand among leads/accounts who are not yet familiar, intent data supports account-based marketing and selling efforts throughout the entire demand funnel.

For example, marketing teams can use intent insights to nurture leads and accounts by analyzing their research activities and serving them relevant content and messaging more likely to convert. Yet only 24% of survey respondents reported message selection/ customization as being one of their use cases. Further, sales teams can use target accounts’ intent signals to inform talk-tracks and follow-up tactics once those leads have been qualified. Those are three use cases you can implement right away.

The gradual expansion into various use cases throughout the buyer’s journey should be part of your intent data strategy. Don’t limit yourself, but don’t move too fast either.

2. Neglecting to Share Intent Data Insights With Sales and Customer Success Teams

The successful use of intent data depends on good alignment between marketing and sales teams (customer success, too). Ensuring there’s an established hand-off process that equips sales teams with appropriate messaging to use on prioritized accounts is critical. Always keep this in mind: account identification/prioritization is only half the value intent data provides; the other half is its ability to tell you which messages to use with those accounts.

While intent data is widely known for supporting B2B marketing and sales efforts, its uses for customer success often go unrealized. This is unfortunate because there is a great deal of opportunity here. The Ascend2/Intentsify survey found that the second most impactful use of intent data is customer account expansion—owned by both sales and customer success.

Intent data can inform you of your current customers’ research activities and investment intentions. This is incredibly valuable for maximizing customer lifetime value (CLV). Marketing teams shouldn’t stop sharing insights after a prospect becomes a customer—it’s important to continue monitoring the research activities of all current accounts to identify any customers likely to churn, as well as those ready for cross-sell. For example, if a current customer is researching one of your competitors’ offerings, then it’s your queue to address any existing issues before it’s too late. Or, if you find a customer is researching a solution that your organization offers but they haven’t yet purchased, then you can reallocate resources to ensure the value of increasing their investment with you.

3. Not Being Strategic When Selecting Topics & Keywords

Blindly choosing intent topics and keywords is a big mistake, as this is a critical process that can largely dictate the success of your intent data investment(s). Yet marketers are often far too lax and forget that there should be a framework in place to determine these selections.

Teams should outline a general buyer's journey for their customers’ path to purchase, then assign unique topics/keywords according to interest categories and buyer’s journey stages. Such tracking is what will provide valuable benefits beyond simple account prioritization—it will allow your team to uncover where target accounts are in their path to purchase, the issues they’re most concerned with, the messaging and content you should use to engage them, and how you should score and route leads from those accounts. (Read here for our guide on selecting and monitoring intent data topics and keywords).

4. Not Acting Fast Enough: Letting the Insights Sit and “Expire”

One of the key benefits of intent data is that it lets marketers know when to reach out to target accounts.

But time is of the essence, as intent signals are only considered valuable for about one week before those insights go “stale.” That’s why Intentsify and other top-performing intent data providers refresh the data on a weekly basis to reveal the current needs and wants of target accounts.

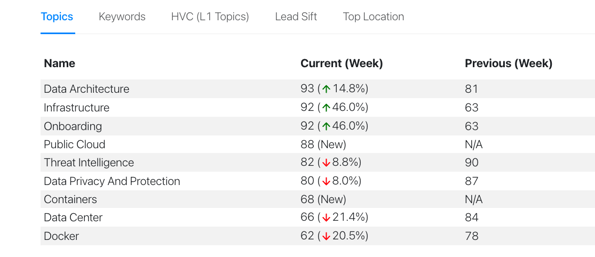

For example, Intentsify’s dashboard below shows the given account’s “spiking” topics for that current week relative to the baseline. You’ll notice all of the topics that were “trending” the previous week are not for the current week.

Think of it this way: A person who is apartment-hunting may be signed up on the best rental websites with alerts setup that instantly notify them when a listing matching their criteria has hit the market. But if they take too long to reach out to the real estate agent, they’ll miss the opportunity—which is often the case in New York City. Similarly, if marketers don’t act quickly on intent insights, they can lose out to competitors.