A Guide to Intent Data Types and Sources

Intent Data | February 10, 2022 | by David Crane

Parts of this article were originally published on CMSWire.

There’s no getting around it: Intent data is complex.

I’ve been a product marketer in the B2B sales and marketing technology space for more than a decade, the last five of which I’ve spent focusing on intent data solutions—and I’m still learning new things all the time. This is partly because intent data solutions are always evolving. And it’s partly because in new tech categories, such as intent data, definitions are…well, let’s say they’re fluid.

Recently I’ve been tasked with helping our company update our new employee training. And the stickler for efficiency that I am, I figured this would be a great time to write a brief guide outlining the various types and sources of intent data. (I’ll discuss the different ways intent is tracked and scored in a later article.)

Please note: The explanations below are from my personal perspective. I’m sure there are other intent data experts who see these concepts differently, which is fine. My aim here is simply to categorize and describe the various elements of intent data in a way that will help current and future intent data users get more out of their intent investments.

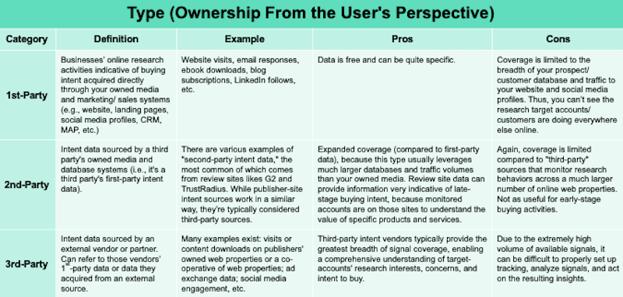

Intent Data Types

First-Party Intent Data

First-party intent data includes businesses’ online research activities indicative of buying intent acquired via your website, landing pages, social media profiles, CRM, marketing automation platform, etc.

In other words, this is data you acquire directly through your owned media as well as your marketing and sales systems.

First-party intent signal examples include:

- Website visits

- Email responses

- eBook downloads

- Blog subscriptions

- LinkedIn follows

Second-Party Intent Data

“Second-party data” is a bit of a misnomer. It's just a subset of third-party data, which is data sourced by another party. The distinction—according to common industry vernacular—is that it's sourced via the third party's owned media and database systems (i.e., it's a third party's first-party intent data).

The most common examples of second-party intent data are product review vendors who also sell intent data, as well as some media publishers who deem their intent products as second-party data. In the grand scheme of things though (in my opinion at least), it doesn’t matter if it’s labeled second- or third-party intent; what matters is the quality of the data, how it’s sourced and scored, and whether you can effectively use it.

Third-Party Intent Data

As I mentioned, this type of data is just intent data from a third party—usually an intent data vendor or a technology provider that offers add-on data or intent-driven solutions. This data may come via another intent data provider’s channel partner, originate from public data or ad exchanges, or occur in combination with their own first-party sources.

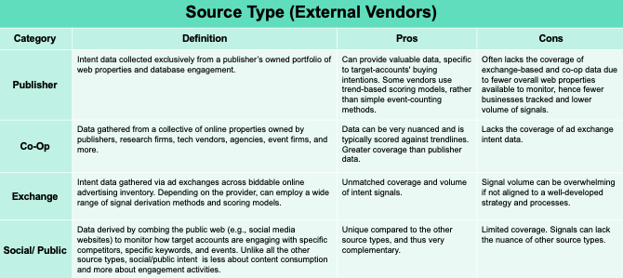

Intent Data Sources

More than four intent data source types exist, but these are the most common.

Ad Exchange Data

Exchange data is gathered via ad exchanges across biddable online advertising inventory, which allows for unmatched coverage and volume of intent signals. In fact, the volume can be challenging if you don’t align its use to a well-developed strategy and processes. Depending on the vendor, this category includes a wide range of signal derivation models and scoring methods.

Co-Op Data

Co-op data is gathered from a collective of online properties owned by publishers, research firms, tech vendors, agencies, event firms, and more. Coverage is typically quite broad with high signal volume (though less so than ad exchange data). Co-op data typically uses topic-based tracking and trend-score models.

Publisher Data

Intent data collected exclusively from a publisher’s own portfolio of web properties is known as publisher data. (I include review sites in this category, but they arguably could fall into their own.) It can be high quality but lacks the coverage of exchange-based and co-op data due to fewer overall web properties available to monitor (i.e., fewer businesses tracked and lower volume of signals).

Social/Public Data

Social/public data is derived by combing the public web—like social media sites—to show which of your target accounts are engaging with competitors, specific keywords, and events relevant to your product and service offerings. Unlike all the other types, social/public intent data is less about content consumption and more about engagement activities, which makes it very valuable. However, insights may be less granular than some of the other types.

Intent Data Takeaways

There isn’t a single best type or source of intent data. Each holds its own benefits that complement the shortcomings of the others. The organizations using intent data with the most success are those utilizing multiple intent sources and types. That’s why 71% of intent users leverage 3 or more intent data sources. (Source: “The B2B Marketer’s State of Intent Data” survey report)

To be sure, leveraging a range of intent data sources, like the unlimited number Intent Activation™ provides, is the best way to ensure you get both the broad and in-depth intent insights you need to focus your efforts on the right organizations in the right way.